QUESTRADE, Registered Retirement Savings Plans (RRSPs), Tax-Free Savings Accounts (TFSAs), and the relatively new First Home Savings Account (FHSA) are pillars in the world of Canadian finance. Navigating investment opportunities in Canada can sometimes feel like a daunting task, given the plethora of options available. However, understanding the significance of these different investment accounts and platforms like QUESTRADE is essential. Today, we delve into how these accounts can shape your financial future.

Table of Contents

QUESTRADE: Empowering Canadians in Investment

QUESTRADE has established itself as a prominent player in the Canadian investment landscape. Offering a user-friendly platform and competitive fees, it has become a go-to choice for both novice and seasoned investors. With features like commission-free ETF purchases and a wide array of investment options, QUESTRADE provides Canadians with the tools to build their financial futures.

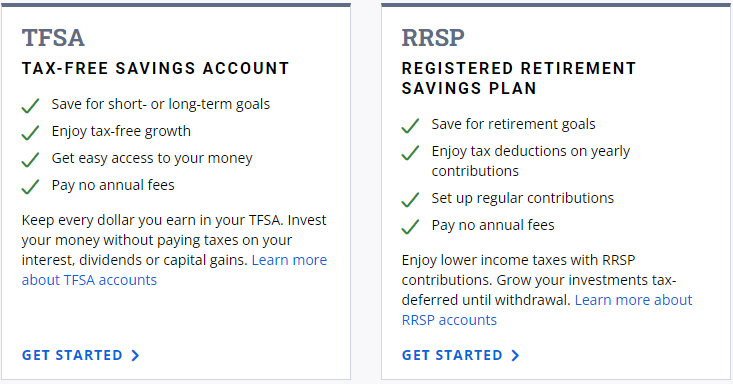

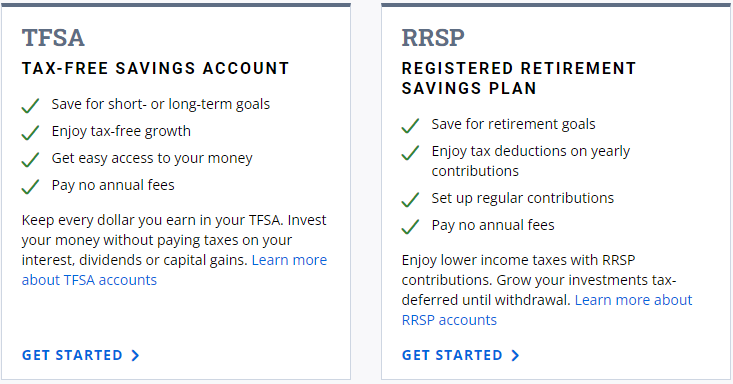

Understanding RRSPs: Securing Your Retirement

Registered Retirement Savings Plans (RRSPs) are a cornerstone of retirement planning in Canada. Contributions made to an RRSP are tax-deductible, allowing investors to reduce their taxable income. The funds within an RRSP grow tax-free until withdrawal, making it an effective way to save for retirement while minimizing tax obligations during the contribution years.

One significant advantage of RRSPs is their flexibility. Investors can choose from a variety of investment options, including stocks, bonds, mutual funds, and ETFs, depending on their risk tolerance and financial goals. Additionally, RRSPs offer the Home Buyers’ Plan (HBP) and the Lifelong Learning Plan (LLP), allowing individuals to withdraw funds for specific purposes without penalty.

Harnessing the Power of TFSAs: Tax-Free Growth

Tax-Free Savings Accounts (TFSAs) have become increasingly popular since their introduction in 2009. Unlike RRSPs, contributions to TFSAs are not tax-deductible. However, the real advantage lies in their tax-free growth potential. Any investment income earned within a TFSA, whether through interest, dividends, or capital gains, is shielded from taxation.

TFSAs offer flexibility and accessibility, making them suitable for both short-term and long-term goals. Investors can withdraw funds at any time without penalty, making TFSAs ideal for emergencies or major expenses. Furthermore, unused contribution room accumulates year over year, allowing individuals to maximize their tax-free savings potential over time.

Introducing the FHSA: A New Frontier in Savings

The First Home Savings Account (FHSA) is a recent addition to the Canadian investment landscape, aimed at addressing the challenges of homeownership. Similar to TFSAs, contributions to an FHSA are not tax-deductible. However, the funds within an FHSA can be used towards the purchase or construction of a primary residence, making it a valuable tool for aspiring homeowners.

The FHSA offers a unique blend of flexibility and tax benefits, allowing individuals to save towards homeownership while enjoying tax-free growth on their investments. With rising real estate prices across Canada, the FHSA provides a welcomed opportunity for Canadians to achieve their homeownership dreams while building wealth for the future.

Conclusion: Building Wealth with QUESTRADE and Canadian Investment Accounts

In conclusion, understanding the importance of investment accounts like RRSPs, TFSAs, and the FHSA is crucial for building long-term financial security. QUESTRADE provides Canadians with the tools and resources to navigate the complexities of investing while maximizing their tax advantages.

Whether you’re planning for retirement, saving for a major purchase, or aspiring to own a home, leveraging the benefits of these investment accounts can help you achieve your financial goals. By harnessing the power of QUESTRADE and strategic investment planning, Canadians can unlock a path towards financial freedom and prosperity.